Interview with Lavinia Iamele from Enel X on the Behind-the-Meter BESS

In this interview we sit down with Lavinia Iamele form Enel X to discuss the overview of Business Case and Taxonomy of Behind-the-Meter Battery Energy Storage Systems in Europe prepared by EASE Task Force on Behind-the-Meter.

Can you explain the significance of behind-the-meter battery energy storage systems (BtM BESS) in the context of Europe’s energy transition and climate goals, and how do they contribute to achieving these objectives?

BtM BESS systems play a key role in facilitating European energy transition, and day by day will play an even more important role as the BTM storage capacity installed is expected to increase more than 5 times up to 2030.

There are 3 highlights on this role:

- Network flexibility and stability: BTM storage makes networks more stable, flexible and resilient, and most of all, has an enormous potential in terms of participation to flexibility services as it can grant to the grid all the needed flexibility at prices more competitive than the current ones. Consider that, in Europe, more than 456 GW of flexibility will be needed by 2030 and more than 800 by 2050. And, at the moment, around 70% of installed flexibility provisions comes from gas turbine, which is of course not in line with the climate goals of the EU. Here , storage will be the answer to overcome the flexibility challenges of the future and is likely to satisfy the great majority of the increasing flexibility needs of Europe, of course provided that effective regulations and policies will be put in place by the countries.

- Energy independence and de-centralization thanks to the Behind-The-Meter configuration: storage enables the efficient utilization of renewable energy, thus reducing reliance on fossil fuels power generation and decreasing carbon emissions.

- Lower price volatility: In the longer run, we expect Energy Storage to help stabilizing energy prices.

And, while the path towards the achievement of climate goals benefits from storage, the individual client gets savings resulting in Reduction in the energy bill, revenues thanks to the participation to energy programs and may also have a backup power granting resiliency in case of outages.

In a nutshell, Storage helps keeping the road open for energy transition while providing value for key stakeholders: the energy network as well as the client.

Your research discusses varying deployment rates of BtM BESS across different European countries. What factors do you believe are responsible for these disparities, and how can countries with lower deployment rates catch up?

Supportive policies, regulatory framework and incentives.

Countries with more favourable policies, such as incentives, streamlined permitting, and grid access for BtM BESS tend to have higher adoption rates; also Electricity prices and tax credits significantly influence Storage adoption.

And, needless to say, the level of public awareness and understanding about these technologies highly impacts deployment rates, as informed consumers are more likely to invest in BtM BESS.

Let’s take the example of Germany, that has one of the highest adoption rates of BtM BESS in Europe, due to robust regulatory support (including feed-in tariffs and net metering) but also policies that have driven the integration of renewables.

Italy has experienced a strong adoption of BtM BESS in the last few years especially thanks to generous government incentives targeting the residential sector. The Business-to-Business sector unfortunately hasn’t received the same incentives, and a similar scheme should be put into force for this segment, together with a fair access to markets that would considerably improve the economic viability of the revenue stacking.

The EU Taxonomy plays a crucial role in classifying environmentally sustainable economic activities. How can BtM BESS and BtM BESS+PV installations benefit from this classification, and what role does it play in promoting sustainable finance and investment in these technologies?

The EU Taxonomy is a classification system, entered into force in 2020, that establishes a common framework for identifying environmentally sustainable economic activities. The fact that BTM storage is identified as environmentally sustainable investment, as it falls within the EU taxonomy, (under the activities of “storage of electricity”, and “electricity generation using solar photovoltaic technology”) is CRUCIAL.

This is so important because this taxonomy acts as a guide for investors, companies, and policymakers in making informed decisions and ensuring that, through different investments and technologies, they are all proceeding towards the same goal of transitioning to a low-carbon and sustainable economy.

In general, being included in this taxonomy accelerates the highly needed financing of BESS projects and helps spreading awareness and knowledge of these technologies reassuring investors that, undoubtedly and demonstrably, Storage helps boosting the navigation toward zero carbon emissions.

Your work outlines several revenue streams for BtM BESS and BtM BESS+PV, such as self-consumption and energy arbitrage. Could you elaborate on the economic viability of these revenue streams currently?

Yes, of course. First of all, again, revenue streams and their economic viability are different region by region, but we can surely identify three basic revenue streams that often make the Business Case profitable through Revenue Stacking.

In case of PV+BESS installations, revenues are mainly derived from self-consumption. This involves storing excess solar energy generated by a photovoltaic system for later use. The economic viability depends on the cost of electricity from the grid, and any incentives or subsidies available. In regions with curtailment, when the excess PV generation cannot be injected into the grid, self-consumption is even more convenient.

Beside self-consumption, and for both BESS Standalone and PV+BESS, peak shaving (also called Demand Charge Management) is a revenue stream extremely relevant in regions with high peak electricity rates. Through a dynamic software, the battery is able to intervene, by discharging, in the moments in which the power consumed by the client or the grid power cost is at its peak, often granting considerable savings to the client.

Moreover, Energy Arbitrage on Tariffs can be done in almost all countries, and its economic viability is higher, the higher the intra-day spread of energy tariffs.

These three basic revenue streams paired together can often make the business case economically viable, and in addition to these, country by country, many more streams involving market participation can be added and stacked together, provided that the access to market is allowed to BTM BESS in the country considered.

You highlighted various barriers to BtM BESS deployment for the EASE paper, including restrictions on BtM exports to the grid and complex tax structures. How can policymakers address these barriers and create a more supportive regulatory environment for behind-the-meter energy storage?

Provided that factors vary a lot country by country and that any supportive measure must follow technology neutrality principles, policymakers should try to bring forward several actions:

- Foster regulations useful to recognise prosumers and their right to produce and consume their own electricity, through clear and enforceable definitions in EU policy.

- Establish regulatory incentives able to streamline permitting and administrative practices,

- Create clear grid connection codes and, most of all, enable fair market participation for BTM storage in countries, such as Italy, where this is not yet fully enabled

- Put into force financial measures for end-consumers such as tax credits, grants, low-interest loans, as well as favourable tax depreciation for storage and solar installations to significantly reduce the upfront costs associated with installing BtM BESS and BtM BESS+PV systems.

Where possible, also fostering time-of-use tariffs would be of great help for the economic viability of BTM BESS.

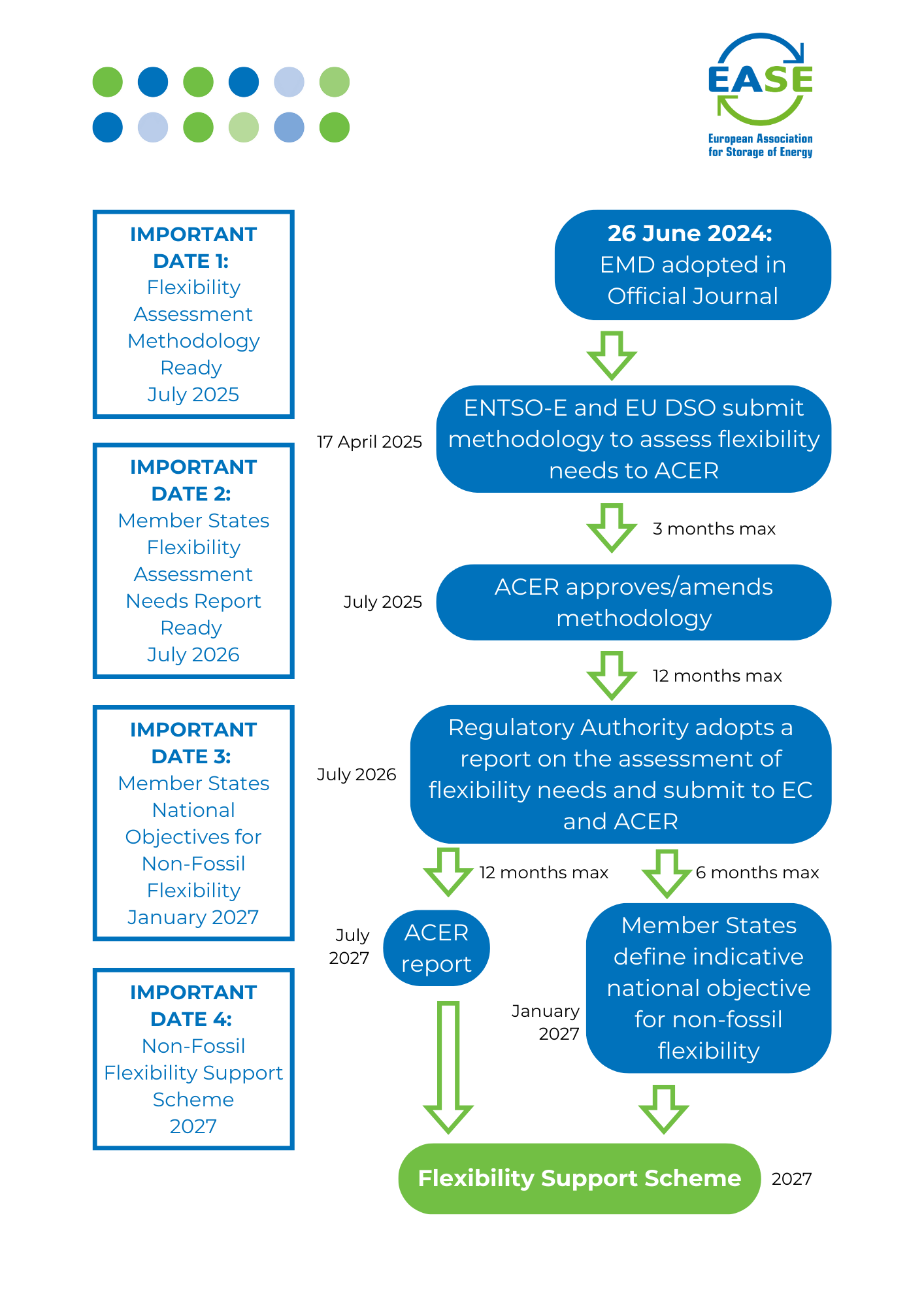

The proposed Electricity Market Design (EMD) revision and other EU policy developments are expected to impact BtM BESS and BtM BESS+PV. Can you discuss how these policies can promote the deployment of these technologies?

The Electricity Market Design (EMD) revision proposed in March of this year, even though still too general to unlock a real and immediate change, reinforces the ground for BTM storage, mainly in 3 ways:

First of all, it gives a clear definition of “Active customer” which is basically a prosumer, and by giving this definition provides an essential foundation to enable and push the participation of BtM BESS+PV customers in the energy and balancing markets.

Secondly, introduces limitations to new net metering schemes for active consumers, improving the case for self-consumption.

Finally, it explicitly and clearly recommends that Member States promote, through regulatory and non-regulatory action, the uptake of demand response and Behind-the-Meter storage.

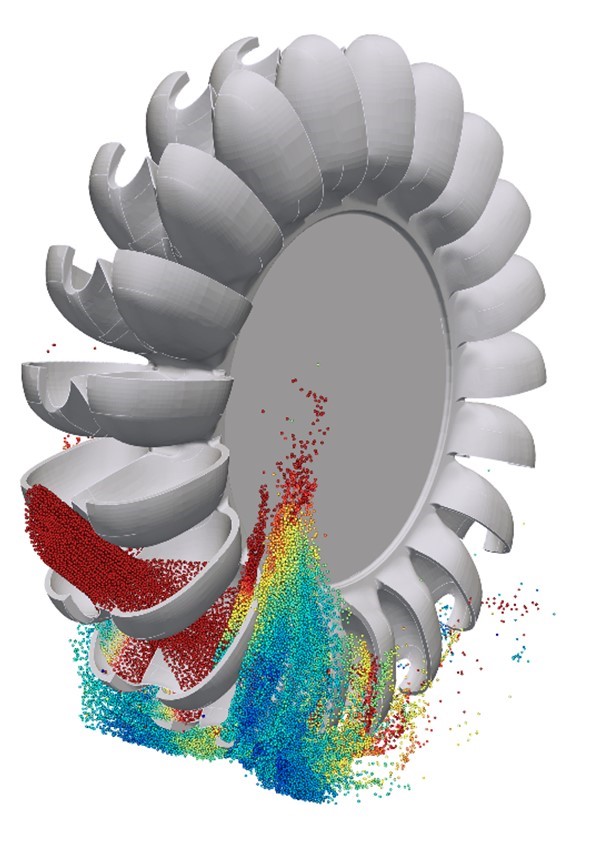

The European Association for Storage of Energy (EASE) is proud to launch its tenth annual Student Award recognising outstanding graduate student research in the field of energy storage.

The European Association for Storage of Energy (EASE) is proud to launch its tenth annual Student Award recognising outstanding graduate student research in the field of energy storage.